The soft drinks category is continuing to grow, proving itself to be resilient to changing shopping trends. This year’s Britvic Soft Drinks Report analyses where this growth is coming from, while we examine how local retailers can make the most of it.

by Kevin Scott

There’s a general acceptance among retailers that the soft drinks category is one which almost looks after itself. If you fill the shelves, customers will empty them. There is truth to this and it is one of the best performing categories in the sector – reliable and profitable. Yet overarching grocery trends are affecting soft drinks in convenience, as detailed in this year’s Britvic Soft Drinks Report. The report details a ‘tale of two halves’, which has seen 60% of shoppers choosing to buy cheaper grocery brands in a bid to save cash.

In categories such as tea and instant coffee, this has led to declines in value of -2.2% and -3.5% respectively. Soft drinks is proving to be more resilient however, having grown by +0.4% in both value and volume last year (ideally you want to see a growth in value with stable volume, but any growth is good).

According to the report, ‘sporting events’, presumably The World Cup and the Commonwealth Games were at the heart of this.

The total market is now worth £7.6bn, a sum so huge that it becomes almost meaningless outside a soft drinks company boardroom. What we want to know about is convenience retailing, and there’s good news on that front: the sector is growing in value faster than the overall market, at +2.8%. Even better news is that grocery multiples are in decline at -0.4%.

This shift in the market should not be underestimated. It ties in with the increase of the ‘little and often’ trend. Are you making the most of this? If c-stores are being preferred to supermarkets then c-stores must ensure their offer fits the bill – so that means chilling a good impulse range that is well merchandised with strong promotional activity and a good range of sharing bottles too.

It is smaller formats that are seeing larger growth – which is great as they generally carry better margins. Can, 500ml/600ml PET and carton formats experienced an increase of +5.9% value sales and +5.8% volume sales in 2014, a trend that that report says is set to grow and develop as all day refreshment opportunities continue to expand.

It is smaller formats that are seeing larger growth – which is great as they generally carry better margins. Can, 500ml/600ml PET and carton formats experienced an increase of +5.9% value sales and +5.8% volume sales in 2014, a trend that that report says is set to grow and develop as all day refreshment opportunities continue to expand.

“2014 was the year when the grocery and convenience channel ‘held steady’ and showed its true resilience in the face of shifting consumer purchasing patterns and wider environmental challenges,” commented Paul Graham, Britvic’s Managing Director GB. “Although these are challenging and changing times, there are significant growth opportunities for soft drinks in the grocery and convenience channel in 2015 and beyond.”

Every year when the soft drink market is analysed it looks at the GB market – and why wouldn’t it? The only downside to this is that the market share of ‘non-fruit carbonates’ of the GB doesn’t come close to replicating the Scottish market, thanks of course to Irn-Bru.

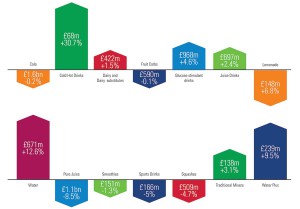

That aside, the results when broken down by sector make for interesting reading. Cola saw a decline for the first time since Britvic started publishing this report. Sales were down -0.2% in value and -1.6%. It remains the daddy of the category though, worth £1.6bn.

Energy and glucose drinks continue to be the star performers – up +4.6%, though sales are growing faster in grocery than in convenience. This could be down to consumers beginning to see energy drinks as something to stock up on, or it could be down to convenience stores not having the range to meet demand. Given the high value of the sector, getting it right is a must for every local retailer.

Having had its ups and downs iced tea and coffee (or the magically-named ‘cold hot drinks’ sector) has now been the fastest growing sector for five consecutive years. Despite a small base, numbers like +30.7% in value aren’t to be sniffed at. The report says drinks of this nature are seen as “affordable, yet indulgent treats”. The advice is to stock up and get your share of that impressive growth.

Water is another sector in growth, with standard water growing +12.6% and water plus +9.5%. The report also notes that despite squash sales being down -4.7%, there has been a raft of innovations which will shape the future of the segment. These include the launch of super-concentrate products such as Robinsons Squash’d from Britvic, Coca-Cola Enterprise’s Oasis Mighty Drops and a variety of other branded and own-label products, all demonstrating the new direction that this segment will be taking, moving squash to an on-the-go consumption.

Shaping shoppers

The Britvic Soft Drinks report identifies a number of different shopper types, all of whom contribute to the soft drinks category in their own way. The first of these is those seeking value and pleasure. A growing trend in saving money on every day items is changing the way consumers engage with grocery shopping. The Savvy Shopper has led the growth in discount supemarkets. Furthermore, 58% of consumers say click and collect services encourage them to visit stores more frequently. The Pleasure Seeker is at the other end of the market and has helped grow all day dining.