Premium beer and cider brands are driving off-trade sales as the cost-of-living crisis continues to bite.

By Gaelle Walker

Forget pinching: as the cost-of-living crisis gets worse, the pressure on consumers is becoming more vicelike grip than needling pinch – and it’s a grip that will only continue tightening as we barrel towards the cold winter months.

This pressure is, many retailers attest, prompting shoppers to forgo expensive nights out at the pub in favour of quality off-trade tipples to enjoy in the comfort of their own homes. As a result, premium ciders and beers, including craft and world varieties, continue to drive growth and breathe life into the category.

IRI Senior Insight Manager Alex Heffernan explains: “Premium and craft ciders have continued to outperform mainstream cider in the off-trade, and we expect this to continue.

“This may seem like a threat, but the trade down from pubs and bars into off-trade premium will outweigh any trade down from premium into mainstream or value cider,” he says.

“As promotions de-escalate and prices increase, shoppers will be looking for the biggest return on the pound they can get. This does not necessarily mean buying cheaper options but feeling comfortable parting with money for something that will make them happy.”

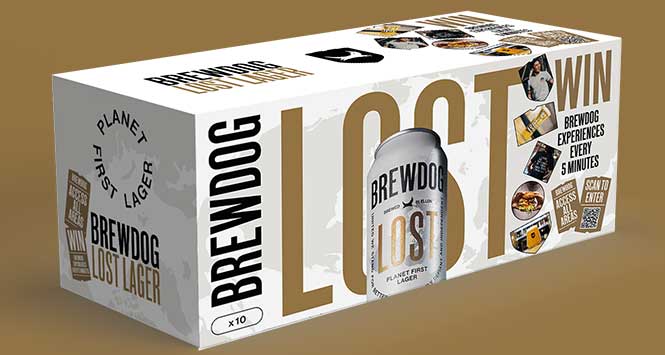

Invigorate your craft beer sales with these tips from Brewdog:

- Seize the opportunity to upsell to larger more valuable pack sizes and formats. Nine of the top 10 craft beer SKUs all contain four or more products.

- Make more of mixed packs which “significantly over index with first time buyers,” and act as a “great introduction to craft beer or gifting product”.

- Display key and “signpost brands” such as BrewDog at eye level.

- Location is key when buying craft – 76% of shoppers want chilled beer from the fridge in c-stores. If chiller space is available, craft should be sited here.

- Focus on multipacks as the key format, with the four-pack can the most important format for craft beer and BrewDog shoppers.

- Seasonal displays to cater for late summer entertaining and upcoming seasonal events such as Halloween and Bonfire Night can create valuable in-store theatre.

Helping them to do just that is the raft of premium beer and cider brands now available which in 2022 have worked to emphasis their quality and taste credentials with impactful marketing campaigns and new products.

The Thatchers brand did exactly that with its recent launch of Thatcher Blood Orange Cider.

Designed to attract new shoppers into cider, the fruity-flavoured launch is being supported by a multi-million-pound investment, including digital, broadcast video, billboard and sampling.

“Thatchers Blood Orange is keeping the excitement and interest in the cider fixture alive for consumers who like experimenting and trying something new,” Thatchers Off-Sales Director Chris Milton says.

“Thatchers has grown in value in Scotland by 35% over the last two years – making it the must stock cider,” he adds.

The trend towards more premium drinks is also being witnessed in the lager category, as John Price, Head of Marketing at KBE Drinks says: “The ‘drinking less but better’ trend has seen consumers increasingly willing to spend more to treat themselves to better-quality and authentic beer and cider options.

“That’s why premium world lagers like Kingsfisher and Sagres are a great option for convenience retailers to stock, as they can typically be charged at a minimum of 30% more than other more mainstream options.

“As the cost-of-living crisis bites it’s sensible to assume that many consumers will prefer the lower-cost option of drinking at home rather than in their local pub or bar, which presents an obvious opportunity for the off-trade.”

Set to kick off on Sunday 20 November, the 2022 FIFA World Cup also looks set to “prove favourable to convenience retailers, as more consumers may choose to watch the matches at home rather than in their local pub beer garden,” Price concludes.

With consumer demand for low and no alcohol options still on the up, convenience retailers are also being urged to allocate more space to this increasingly important segment, which up until now has been dominated by the multiples.

According to the Westons Cider Report 2022, 6% of consumers now engage within no and low cider. Westons says that retailers should “expect value growth to continue, as volume per buyer increases.”

Thatchers’ Chris Milton agrees: “The popularity of alcohol-free options continues to rise and will play a key role in drink selection this festive season.

“Shoppers know there are now great tasting alcohol-alternatives readily available, and that’s why retailers shouldn’t compromise, and should have the UK’s number one alcohol-free cider, Thatchers Zero, on their shelves.”