PayPoint is changing its commission payment procedure to help retailers reduce the amount of cash they need to bank.

Currently, retailers see a weekly commission credit on a Tuesday as well as a normal transactional amount settled by direct debit or credit. For SBIs dated November 13, 2017 onwards, PayPoint will deduct commission owed to retailers from the transactional monies due to it.

This means that from November 24, 2017, on a weekly basis, Settlement Notices will look slightly different as they will include details of commission due.

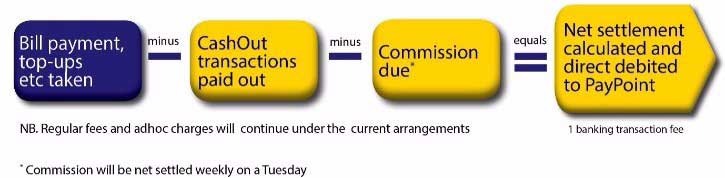

PayPoint said that this should reduce banking charges, as retailers only need to bank the net PayPoint figure (cash taken in, minus CashOut transactions, minus commission due). Direct debit/credit charges could also fall, because of less PayPoint banking transactions.

No action is required from retailers. Commission will appear on Settlement Notices, which can be viewed via PayPoint devices and/or by logging on to MyPayPoint.com. This will advise retailers of the amount needed to bank. It is essential that the notified amount is banked on time, as any failed direct debits will incur a charge.

Retailers seeking further guidance can browse frequently asked Single Daily Settlement questions or email PayPoint quoting their retailer number in the subject line.