Last month the ABC released its latest report into the state of the magazine market and with digital titles being included for the first time, it marks an important moment for the industry, and retailers should ensure they know what is selling.

by Kevin Scott

There is no category quite like magazines. It’s a hugely time consuming job to manage the magazine section and many retailers have a store ‘champion’ responsible for ensuring the right titles are in stock and returns are dealt with quickly and efficiently. Like newspapers there is a slight downward shift in the market but with the ABC publishing its most recent report, it’s evident that the most popular magazines in the country are still actively purchased by over 1.2 million people. That’s quite a number. The fact that this latest set of results saw digital editions get their own chart is a real watershed for an interest that is turning to tablets to return to growth. Men’s Health led the way there with over 12,000 average net distribution.

In the regular chart TV titles dominate the top of the charts (for the full top 100 actively purchased magazines in the country, see columns) with H Bauer’s TV Choice retaining its top slot with 1,230,076 copies sold. Behind it is IPC Media’s What’s on TV (1,220,128) before the numbers drop to 885,857 for the old favourite: The Radio Times. Take a Break (also H. Bauer) is the first non-TV magazine and it features at number four with 741,233 issues sold. What is interesting is that each of the top five saw year-on-year declines, with even the TV Choice down 5.7%.

One thing that is evident from looking at the top 20 titles is that there is generally very little movement and so retailers with very limited space should ensure they stick to this list – not counting customer orders of course. In that top 20, only two titles have jumped into it: TV Times (up four places to 17) and Woman (up three to 20), replacing Star (which plummeted over 30% yoy) and Heat (down 20.1% to number 24). This indicates there may be a shift away from celebrity titles – which may in part be due to the strength of newspaper websites – with the Daily Mail website breaking records for the number of unique monthly visitors.

Woman’s Weeklies

Northern & Shell title Star was the major casualty in the most recent results, although it was not alone – all but one major woman’s weekly titles suffered a drop in sales over the last six month period. Star dropped 29.9% year-on-year, while OK!, its sister title, dropped 11.8% year-on-year. Hello!, a major rival of OK! has been listed in the ‘women’s lifestyle/fashion’ sector for some reason saw a drop of 18% to just over 305,000. With leading women’s weekly, Take a Break also falling along with New!, Chat and Closer, it was left to National Enquirer to post the sole sales boost with a 0.4% yoy growth to 63,987.

Men’s Monthlies

In the men’s segment it was the upmarket titles that impressed. Esquire and GQ both outperformed the increasingly dated ‘lads mags’.

Esquire grew 12.6% in the last six months but failed to make the top 100. It is unusual for a men’s magazine to show growth however. GQ forged ahead of FHM in another interesting development with sales of 120,141, making it the top selling men’s title at 81 in the list.

FHM dropped to 114,677. Weekly mags Nuts and Zoo continued to fall back with the former falling 29.7% year-on-year.

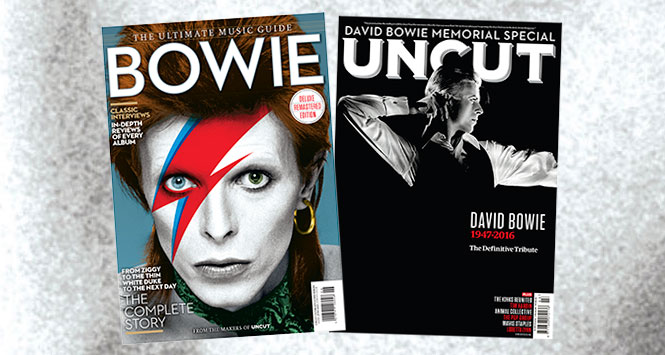

Film & Music

The film and music category is another to have suffered at the hands of the internet, though leading title Empire managed to post a 0.4% year-on-year increase, with monthly sales of 167,748. This saw the title extend its lead over Total Film, which dropped 7.8% yoy to 65,381.

The music market made for some fairly grim reading with Kerrang! dropping 8.4% to 38,556 while NME dropped 16.6% to 23,049. The strength of online resources played a part in this. On the music monthlies, Mojo, Uncut and Q all saw slight drops in sales.