The new 2017 Shopper Stock Take survey findings suggest shopper priorities are changing towards a quality-led model with fewer and fewer seeing the benefit in single trip big-basket shops.

A new report says shoppers are placing better product quality and service higher in their priorities above competitive or cheapest prices. The second annual ‘Shopper Stock Take’ report from Shoppercentric, the independent shopper research agency, also claims that the trend away from the big weekly shop is continuing with fewer and fewer customers shopping this way..

The report measured opinion from over 1,000 shoppers across the UK, asking them about their expectations of the grocery retail sector.

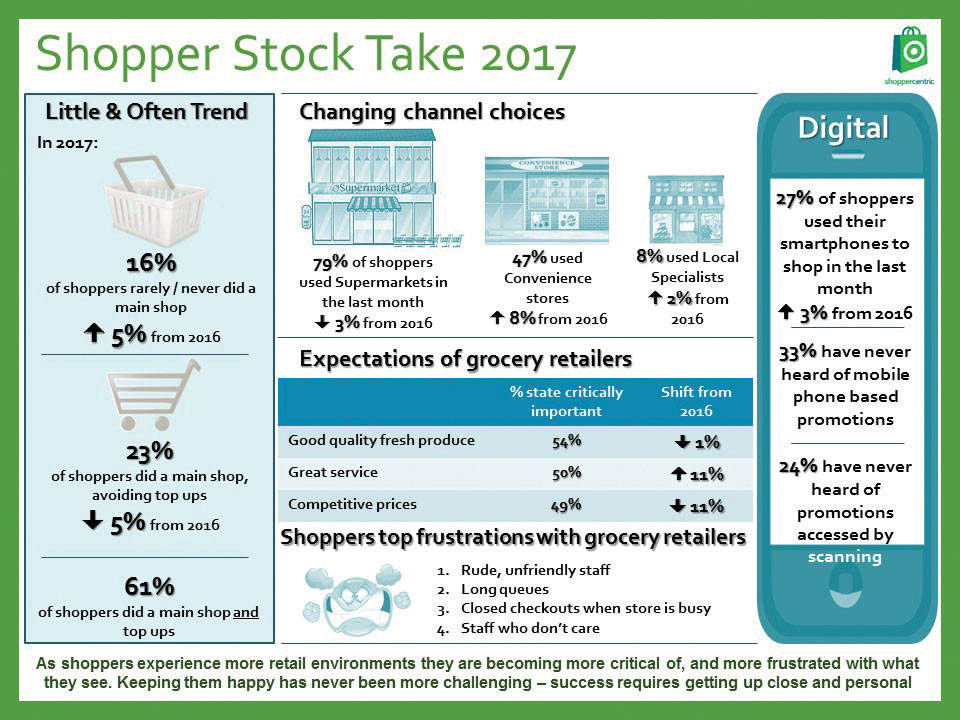

Increasing amounts of hard evidence are backing up the anecdotal reports of shoppers abandoning the weekly big shop habit in favour of a little and often approach. The proportion of shoppers who do lots of small shops and claim rarely or never to do a main shop has grown to 16%, up from 11% in 2016. On average, these shoppers visit six different stores a fortnight – revealing very little loyalty to any particular brand or store.

Shoppercentric says, however, that 23% of shoppers still do a main shop and try to avoid top-up shops in between. That said, some 47% of shopper regularly use the convenience channel, up 8% year-on-year, according to the report.

The Shopper Stock Take also found that more of us have become quite promiscuous in our shopping habits, with 61% combining a main shop with periodic top ups, a fall from 67% the previous year.

Just over half of all shoppers (51%) still remain faithful to a single store or supermarket, or a small combination of outlets, since that number agreed with the statement that fewer, bigger shops were more efficient than lots of little ones – down from 58% in 2016.

“Big box grocery retail is not the future so it’s important that changes in shopper behaviour are noted – and acted upon,” said Danielle Pinnington, Managing Director at Shoppercentric. “It’s also essential news for the brands that supply these retailers, because small store distribution and ranging takes far more thinking than the one-size-fits-all template.”

Retailers too, have to shape up to serving the expectations of a diverse customer base, the report suggests. There is a list of priorities that around half of all shoppers questioned say are critically important. Contrary to popular perception, the demands that top the list of shopper desires is product quality, with 54% of shoppers looking for good quality fresh meat, fish and produce.

Retailers too, have to shape up to serving the expectations of a diverse customer base, the report suggests. There is a list of priorities that around half of all shoppers questioned say are critically important. Contrary to popular perception, the demands that top the list of shopper desires is product quality, with 54% of shoppers looking for good quality fresh meat, fish and produce.

Great service comes in a close second place with exactly half of shoppers putting that top of their priorities, a significant increase from 2016 – up 11%. Competitive pricing, as opposed to cheapest price, has fallen from 60% of shoppers seeing it as a critically important priority to 49%. Having the cheapest prices also fell, six points down to 37%.

“The changing priorities for today’s UK shoppers are critical to note and retailers must recognise that price is but one part of the value equation, along with time efficiency as well as satisfaction,” observes Pinnington. “With low prices having almost become a given, the more added value elements are now performing a critical role in differentiating between competitors. The retail experience, of which service is a core part, is becoming more of a focus for shoppers who want to feel important to the retailer, rather than just being a walking wallet. And they want their needs to be recognised and reflected, through retail experiences that save time and ultimately make life easier.”

Giving the customer what they want is not confined to product though, as the report alludes. There are some factors which are seriously annoying shoppers, with rude or unfriendly staff top of the hit list. Across all five channels covered in the report (from multiples to specialists) there was an 8% rise in dissatisfaction with customer service – with 62% noting it as their main shopping concern, keeping it above the bug-bear of long queues, a problem for 8% more shoppers than last year. Other leading causes of complaint included promoted products running out too quickly and messy shelves.

The trend for ethical shopping makes a strong showing in the 2017 report. When prompted, 66% of UK shoppers agreed that they would prefer it if the money they spend benefits British businesses, and almost the same figure agreed when that was subtly changed to benefitting local businesses.

There’s obviously lots for local retailers to ponder, and be encouraged by, in the Shopper Stock Take. “It’s no small task,” concluded Pinnington. “There is a very real need for a back to basics approach, with good housekeeping, clean and clear promotions and good stock availability etc., to ease shopper frustration and prevent undermining a positive retail experience.

“This year retailers must get amongst their shoppers, see retail through their eyes, build the stores, merchandise the categories and create the digital solutions that truly support the purchase process. Everything counts to the shopper as they continue to flex their spending powers.”