It’s not the end of the world but can we see it from here?The local retailing industry has undergone a seismic shift in the last few months with a packed November seeing the entire face of the sector changed forever. So, what will the world look like when the dust settles?https://www.slrmag.co.uk/consolidation-end-world/

by Antony Begley

As Sir Alex Ferguson famously commented: “Bloody hell!” He was talking about a game of football of course, but his reaction was roughly the same as that of the entire local retailing industry to the bombshells of the last couple of weeks.

Firstly, Booker and Tesco got the green light from the CMA for their £3.7bn merger, creating in the process a £60bn behemoth, a good sight larger than the entire wholesale sector combined at around £25bn. Then, as we were still digesting that deal, 75.79% of Nisa’s members elected in favour of a £137.5m takeover bid from the Co-op to acquire the entire business.

Meanwhile rumours of a deal between the Co-op and Costcutter turned out to well-founded when a deal was announced that will see the Co-op become Costcutter’s exclusive supplier from the vaguely worded start of ‘spring 2018’.

And as if that wasn’t enough, P&H ignominiously slid into administration with the administrators, PwC, confirming that 2,500 jobs were to be lost with immediate effect.

Cast your minds back a little to July and you can also throw Morrison’s sole supply contract for McColl’s into the mix for good measure. The world, it seems, has turned upside down – and attempting to guess where this will leave Scotland’s local retailers is a risky business.

Winners and losers

Sorting winners from losers at this stage is equally fraught, but it’s probably safe to assume that most Booker-supplied Premier, Londis, Budgens and Family Shopper retailers are reasonably content at being reversed into the retailing juggernaut that is Tesco. The supply chain and buying power advantages they should gain access to will be mouth-watering for many retailers, but the move will not be without concerns too. Retailers retaining full independence and full control of their stores has always been a strong suit of Premier in particular – but will they be required to sacrifice some that right to self-determination in return for the bounty that the massively-enlarged business could facilitate for them?

“There are concerns of course, but we’re viewing the move as a really positive one,” says Edinburgh Premier retailer and SGF President Dennis Williams. “The buying power of the group will be second to none and we will gain access to a raft of benefits that will help us grow our businesses. Tesco’s fresh food expertise is legendary, its supply chain is superb and it has great expertise in areas like customer engagement and offering other services like telecoms and financial services. All of that can only help Premier retailers set themselves apart.

“We’ve been with Booker for 20 years and since Charles Wilson took over he hasn’t put a foot wrong. He’s made lots of decisions that looked quite odd at the time but with the benefit of hindsight we realise that he’s a man that really knows what he’s doing. He understands retail like no-one else and I for one have full confidence that this deal will be another masterstroke.”

As the stream of relentlessly positive financial results show, Booker was a formidable force on its own under Wilson. A turbo-charged Booker with Tesco by its side has the potential to change the industry for good.

Staggering over the line

Despite significant disgruntlement on social media and in the trade press in the run up to the Co-op vote, over 75% of the 1,190 Nisa members who own the company voted to endorse the deal, although it’s worth bearing in mind that a minimum of 75% was required to get the deal over the line – so in that sense the deal made it through by the skin of its teeth.

There persist rumours of a legal challenge to the deal but those remain merely rumours for the time being.

That said, the vast majority of Nisa members were clearly happy enough to back the Co-op to give them the security and solid platform they craved to build sustainable businesses for the future. As part of the deal, the Co-op agreed to take on Nisa’s not insignificant £105m debt, putting the business on a much firmer footing.

The Co-op will add Nisa’s 3,200 stores to its existing portfolio of 3,800 outlets and in the process will significantly boost its purchasing power.

Nisa Chairman Peter Hartley said: “We are delighted that our members have chosen in such significant numbers to vote in favour of Co-op’s offer. We as a Board are firm in our belief that a combination with the Co-op is in the best interests of Nisa’s members. The convenience store environment is changing rapidly, and is unrecognisable from that which existed when Nisa was founded more than 40 years ago. Co-op will add buying power and product range to our offering, while respecting our culture of independence.”

Long-term benefits

Nisa clearly expects the deal to bring a mix of immediate and long-term benefits for Nisa members, not least of which are access to greater scale and the Co-op’s wide-ranging own label proposition. Members have been guaranteed that they will continue to enjoy the independence to operate their stores as they wish, and will also be able to remain part of a member-owned organisation within the growing UK convenience retail sector.

The deal brings to an end an unhappy period for the business which has never truly been the same since the acrimonious split with Costcutter in 2013 when the latter chose Palmer and Harvey as its supplier; an ironic choice given the recent collapse of P&H.

Nisa retailer and former Nisa Board member Harris Aslam says he “remains positive and upbeat” about the Co-op deal. “The Tesco-Booker deal made a lot of the deals that followed inevitable in some senses. There had to be some changes although not all the changes that happened were those that we might have expected. I had been a little sceptical about the Co-op offer for Nisa and I would have liked a little more detail and assurances built in, but I’m now quite optimistic about the future.

“The Co-op offers us lots of opportunities and we fully intend to take advantage of them within our business. Having access to that extended range and chilled offer, as well as the own label range, will help us enhance our own offering. We have never been wholly reliant on Nisa anyway, as we have always prioritised local and regional sourcing, but we just need to focus even harder on differentiating ourselves from the competition, particularly with more and more of the market controlled by fewer and fewer businesses.”

Cause for concern

One area that does concern Harris, however, is the fact that in two of his seven stores the nearest competitor is a Co-op. “It hasn’t been made entirely clear how that situation will be handled,” he says.

As for Costcutter, with a significant gap between now and when the new Co-op supply deal kicks in – “spring 2018” – there is a lot of work to do to keep Costcutter retailers on-side with some sort of short-term arrangement to ensure timely, accurate store deliveries in the interim.

As a customer of Costcutter myself at Woodlands Local, I can say that the collapse of Palmer and Harvey has had an immediate and severe impact. A text message from Costcutter on the day P&H went into administration simply stated that there would be no more Costcutter deliveries for the rest of the week, contingency plans were being drawn up, direct to store capacity was being increased and updates would be issued.

A representative of the company got in touch to confirm that a short-term solution should be in place “within 48 hours” but we were left to our own devices to wrestle with the challenge of stocking our shelves with the fresh, chilled and frozen lines that they were unable to deliver.

Milk and bread are clearly the two main concerns but as SLR was going to press our local Booker has agreed to meet our immediate milk needs while Graham’s Dairy has been in touch to provide a longer-term solution if required.

Running alongside all of this is the intriguing sideshow which sees Costcutter finally reunited after a fashion with Nisa in the most unlikely of circumstances. A major question surely lies in how the two will differentiate themselves from one another when they are both buying from Co-op. Is an even tighter reunification ahead, and could the two ultimately be more fully merged at some point in the future? Who can tell?

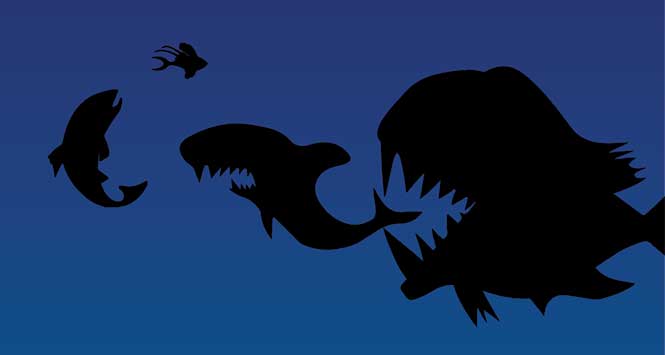

Feeding frenzy

One sure-fire upshot of all this consolidation is a feeding frenzy among the fascia, symbol and franchise groups. The flux is almost certain to lead many independent retailers to consider their options and there will be no holds barred when the big boys take the gloves off as they attempt to grow their portfolio of stores in the coming weeks and months.

There will also be a parallel feeding frenzy among the remaining wholesalers, keen for a share of the £4bn+ of sales that P&H was mopping up previously, the bulk of it tobacco. One of the most obvious questions, then, is where will Tesco now get its tobacco? Tesco was P&H’s largest single client and while on the face of it, it made no commercial sense for Tesco to continue buying from P&H when it was just about to acquire its own wholesaler, the status quo was emphatically and very publicly maintained, presumably to avoid ruffling too many feathers during the CMA investigation. Now that P&H has gone, is Tesco now free to simply cut out the middle man and use Booker?

The ultimate question for our industry is whether this mass-scale consolidation will be a good thing for convenience retailing or not. The answer to that question will depend on the perspective of the retailer or wholesaler asking it, but it’s abundantly clear that a lot of water will pass under a lot of bridges before anything like a clear picture emerges.

“It’s a sad, sad day for the wholesale industry and it’s also a pretty scary situation,” says Scottish Wholesale Association Executive Director Kate Salmon. “The face of the industry has changed beyond recognition in a few months. The loss of 2,500 jobs at P&H is disastrous for thousands of families across the UK and I feel for everyone who worked for what was an iconic business in our trade.

“As for the future, it’s impossible to predict how this will all play out now, but one thing is for sure: this industry has demonstrated its resilience in the face of adversity time and time again, and I fully expect it to cope with this latest set of challenges. But there’s no question this is an unprecedented period in the history of wholesaling and convenience retailing.”