How important would you say a strong soft drinks range continues to be for a convenience retailer?

A strong soft drinks range is absolutely essential for a convenience retailer, 2018 was a year of real change across the soft drinks market and it’s no different in the convenience channel.

Soft drinks is the number one category in convenience and outperformed all other categories, with growth of +7.7% [IRI Britvic Convenience 52 we 30.12.2018].

Retailers need to ensure they have a good range that caters for every sector: waters, carbonates, sports and energy, etc. It’s important to also ensure the brand leaders are well represented and act as a signpost for those sectors.

Would you say the sugar tax has impacted negatively on sales or has it driven new/different opportunities?

While the Soft Drinks Industry Levy (SDIL) has certainly impacted the sector, sales remain strong across the board. The soft drinks category in general is forecasting growth with 35% of retailers [Him! Wholesale study, 2018] expecting sales of soft drinks to increase in volume.

Since the SDIL came into effect last year, we’ve seen a significant uplift in people switching from full sugar drinks into low and no added sugar alternatives – showing that consumers have embraced the change, and manufacturers are adapting their brands. This trend is helping Pepsi MAX to continue taking share, while 7UP Free, R Whites and Tango have all seen growth following the SDIL [Britvic, Preliminary Results, November 2018].

Is Britvic putting more focus on low/no sugar alternatives in light of regulation as well as changing consumer lifestyle habits?

Health is an ever-increasing concern, with 65% of people agreeing that they are proactively trying to lead a healthy lifestyle [CGA Brand Track Consumer Confidence Survey Q4 2018]. As such, low and no sugar alternatives have been a key focus for us and meant that 90% of our innovation in 2018 was focused on low and no added sugar products [Britvic Annual Report 2018]. We are also proud to say that 99% of our GB owned brand portfolio, such as Robinsons, Drench and J2O, is below or exempt from the SDIL.

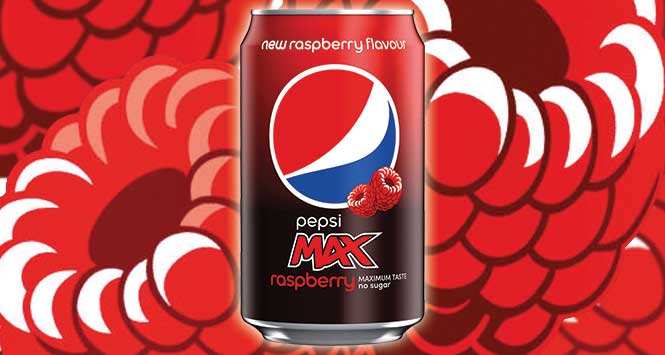

For the convenience channel, it’s important that we continue to offer choice in this growing market to help retailers drive soft drink sales among health-conscious shoppers. One of our latest pieces of innovation includes Pepsi MAX Raspberry which delivers on all three category drivers – taste, health and relevance. With Pepsi MAX a driving force in no sugar cola, this new raspberry flavour will be a welcome addition to the portfolio.

What NPD has Britvic introduced over the past year and has this been tailored to these changing consumer trends e.g. Healthier Lifestyles, Adult Soft Drinks & Premium Brands

One of our latest pieces of innovation includes Pepsi MAX Raspberry which delivers on all three category drivers – taste, health and relevance. With Pepsi MAX a driving force in no sugar cola, the new raspberry flavour was a welcome addition to the portfolio.

The category in general is seeing exciting innovation focused on a more premium, natural approach, with ingredients such as cucumber, rhubarb, orange blossom and kiwi coming to the forefront. This is driven by health focused trend with the soft drinks category going through a shift in recent years. Our latest Soft Drinks Review shows that this is driven in part by the impact of the Soft Drinks Industry Levy (SDIL) and the rise in demand for premium offerings.

Since the Soft Drinks Industry Levy (SDIL) came into effect, we’ve seen a significant uplift in people switching from full sugar drinks into low and no added sugar alternatives across the board – showing that consumers have embraced the change, and manufacturers are adapting their brands. This trend is helping Pepsi MAX to continue taking share, while 7UP Free, R Whites and Tango have all seen growth following the SDIL [Britvic, Preliminary Results, November 2018].

This has been on our agenda since long before the SDIL and we are proud that 99% of our GB owned brand portfolio, such as J2O and Britvic Mixers, is below or exempt from the SDIL [Britvic Soft Drinks Review 2018].

Continuing on the Sustainability theme, does Britvic have any thoughts on the introduction of DRS in Scotland?

Britvic are enthusiastic supporters of the introduction of a well-designed GB-wide DRS scheme – as the most effective method of increasing the quantity and quality of recycled PET bottles and cans. It supports our aim of moving towards a truly circular model for packaging and towards the circular economy we all want to see.

We welcome the Scottish Government’s announcement; however, we are concerned about some of the principles which go against what we would consider to be a “well designed” scheme that is created to maximise success.

International best practice suggests that the deposit level should be determined by the management company on the basis of what is needed to drive returns. In setting the fee level in advance, the Scottish Government is diminishing the scope of the system to adapt according to need. The inclusion of glass raises costs and complexity which creates unnecessary risk to the successful launch of a DRS in Scotland. We also remain concerned about the feasibility of introducing a well-designed and effective DRS in such a short timeframe. We continue to believe that a GB-wide full DRS for all plastic and can beverage containers remains the best way to increase recycling levels.

Finally, with all of the above going on in the sector, is there any ranging and merchandising advice for retailers in today’s massively evolving category?

- Stock the right range – For immediate refreshment, it is important to stock a broad range of branded soft drinks from established segments such as water, water plus, carbonates, juices and juice drinks, energy and vitality drinks.

- Great merchandising – We recommend segmenting the chiller into four areas – carbonates, stills, energy & vitality and water & water plus. Always make sure single serve drinks are kept chilled and ready to drink straight away to drive impulse purchase from thirsty shoppers.

- Highlight NPD – Shoppers want to discover new things, so make sure new soft drinks stand out in the chiller or on-shelf, with additional point of sale where relevant.

- Be visible – Make sure soft drinks are in a prominent location in store, such as close to on-the-go food items for smaller formats and use gondola ends for take-home soft drinks. Restock shelves frequently to keep up with demand – any gaps in the chiller represent potential missed sales.